Kickstart your new year with smart money moves. Learn practical tips to help you build a budget, save for the future, and pay down debt. Discover how to set achievable financial goals, track your spending, and create an emergency fund to stay ahead. With these simple strategies, you’ll feel confident, in control, and ready to make the most of your money and your financial future.

Are You In An Unhealthy Relationship — With Your Finances?

This time of year can be a great month to “check in” on the relationships in our lives to ensure they’re stable, healthy, and on track. While you may do this with family, friends, and colleagues, there is one relationship check-in that you might be missing. How is your relationship with your money doing?

Dawn of Your Golden Years, 5 Steps to Take as You Prepare for Retirement

The start of a new year is a great time to think about preparing for retirement. RRSP contributions you make during January and February can be used in the current or previous tax year, wherever it’s most beneficial for you. But when retirement is looking over the horizon, any month is a good month to . . .

Fitness Goals for 2025: How Much Are They Costing You?

What are the most popular goals for 2025? Unsurprisingly, fitness goals, weight loss, and healthier eating are some of the most common New Year’s resolutions. There’s nothing like a brand-new year to bring about some self reflection and self improvement. But in that first rush of post-holiday, “new year, new me” enthusiasm, it can be . . .

How to Manage Christmas and Holiday Stress

Moving through this “merry” month, you may be juggling a variety of holiday tasks and projects, but what about managing your Christmas and holiday stress levels? A recent survey from Angus Reid* reports that Canadians are feeling the holiday stress; half (53%) say this year feels more emotionally stressful than past holiday seasons. Meanwhile . . .

Christmas on a Budget – Ho, Ho, How to Save and What Not to Forget

Here it comes again, it’s the most wonderful expensive time of the year! It’s no secret that as the holidays get closer our spending increases and having Christmas on a budget seems very unlikely. According to a recent report by Equifax, credit card spending and consumer debt has gone up by almost 4% during this time, compared to . . .

Avoid Donating Yourself Into Debt – Outline Your Budget & Other Ways to Give Support

Charitable organizations and the people they serve are extremely appreciative of the donations and support they receive. Most depend on fundraising and the generosity of the community. However, there can be times when donating financially isn’t possible, even if you have a longstanding commitment to doing that. If . . .

3 Reasons to Check Your Free Full Credit Report

Few things are free in life, but thankfully, checking your full credit report is one of those things. Equifax Canada and TransUnion Canada, our official credit bureaus, each have their own version of your credit report. Other companies pull info from these reports when making decisions like whether to approve a credit application. If you haven’t checked your report before, here are 3 reasons why . . .

Soft vs Hard Credit Check in Canada: Credit Rating Impact & Common Questions Answered

Wondering what’s the difference between a soft vs hard credit check in Canada? Put simply, a hard check affects your credit rating, but a soft check doesn’t. Also known as credit inquiries or credit pulls, these are a way for companies to see the info on your credit report. Of course, you can also check your own report. Read on to learn more about . . .

4 Money Mistakes that Are “Penny Wise Pound Foolish” (and How to Fix Them)

We all like to save money, but some tricks to save can actually cause costly money mistakes. You might have heard of this as being “penny wise pound foolish,” the origin of which comes from a quote in a 1600s book on melancholy. Having your efforts work against you can certainly feel discouraging! While there’s nothing wrong with counting pennies, seeing the big picture ensures . . .

5 Money Saving Tips for a Single Person Grocery Budget

Figuring out a single person grocery budget that’s good for your wallet and stomach can be tricky. While there are plenty of grocery shopping tips that work for any household, living alone has its own quirks. So how much should a single person budget for groceries? The average cost of food per month for one person in Canada used to range from $225-$250, but can be much higher now due to rising living costs. Here are . . .

How to Back Out of a Financial Commitment with Family Gracefully

Has a family member asked you for financial support? Think twice about an agreement to provide a loved one with money or to co-sign a loan for them. As much as you might care for that person and want them to succeed, you also . . .

How to Save $5,000 in One Year with a Budget Money Plan

How to Save $5,000 in One Year with a Budget Money Plan by Kevin Sun Want to save $5,000 in a year? That extra money in the bank could go...

3 Tips to Help Teenagers Learn Money Management Skills

3 Tips to Help Teenagers Learn Money Management Skills by Kevin Sun Learning money management skills will help teenagers be financially...

New Mortgage Rules: Are They Really What They Seem?

New Mortgage Rules: Are They Really What They Seem? by Julie Jaggernath Wondering what Canada’s new mortgage rules mean in plain English?...

How to Save More Money When Social Media Makes You Want to Spend

How to Save More Money When Social Media Makes You Want to Spend by Julie Jaggernath Worried that social media is making it hard to save more...

How to Use Back to School Shopping as a Lesson in Financial Literacy for Your Kids

How to Use Back to School Shopping as a Lesson in Financial Literacy for Your Kids by Julie Jaggernath Teaching financial literacy to your...

How to Plan for Homeownership During Difficult Times

How to Plan for Homeownership During Difficult Times Guest post by Pauline Tonkin The landscape for Canadian homeowners and buyers has shifted...

What Teenagers Should Know Before Buying a First Car at 17

What Teenagers Should Know Before Buying a First Car at 17 by Julie Jaggernath Have a teen who is looking at buying their first car at 17 or...

3 Tips to Save Money when Shopping Online

3 Tips to Save Money when Shopping Online by Kevin Sun Out of both convenience and necessity, online shopping – which may or may not save...

Is a Balance Transfer Promotion with Convenience Cheques Worth It?

Is a Balance Transfer Promotion with Convenience Cheques Worth It? by Julie Jaggernath Have you ever received some "convenience" cheques from...

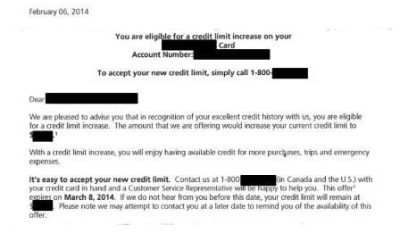

Does It Make Sense to Accept a Limit Increase for Your Credit Card?

Does It Make Sense to Accept a Limit Increase for Your Credit Card? by Julie Jaggernath Have you received an offer to raise the limit on your...

How Do Part-Time Jobs Teach Teens to Budget?

How Do Part-Time Jobs Teach Teens to Budget? by Julie Jaggernath Teaching teens to budget helps improve their money management skills when...

Got an Unexpected Windfall? What to Do with the Extra Money

Got an Unexpected Windfall? What to Do with the Extra Money by Julie Jaggernath After getting an unexpected windfall like an inheritance, are...

How to Prevent Financial Problems: Organize Your Finances

How to Prevent Financial ProblemsOrganize Your Finances by Kelly Gabriel Thinking about how to prevent financial problems might make you...

9 Practical Steps to Solve Your Financial Problems Without an Ivy League Education

9 Practical Steps to Solve Your Financial Problems Without an Ivy League Education by Julie Jaggernath Worried about your debts and trying to...

Missed the Income Tax Return Deadline? 5 Reasons Why You Should Still File

Missed the Income Tax Return Deadline?5 Reasons Why You Should Still File by Julie Jaggernath There aren’t many people who truly look forward...

4 Tips to Save Money on Low Income

4 Tips to Save Money on Low Income by Kevin Sun Do you struggle with saving money on low income? When every pay cheque you earn is just barely...

#LearnWithCCS Webinars & Workshops: How to Enter the Monthly Draw & Win a $50 Gift Card

#LearnWithCCS Webinars & Workshops:How to Enter the Monthly Draw & Win a $50 Gift Card Want chances to win a $50 gift card while learning how...

5 Last-Minute, Affordable Mother’s Day Ideas She’ll Love

5 Last-Minute, Affordable Mother’s Day Ideas She'll Love by Julie Jaggernath If you are scrambling for last-minute, affordable Mother’s Day...

How to Really Shop and Save Money

How to Really Shop and Save Money by Kevin Sun Many Canadian stores advertise “shop more and save” style promotions that entice people with...

How Much Should Your Down Payment on a First House Be?

How Much Should Your Down Payment on a First House Be? by Kevin Sun It’s normal to feel pressured to get a down payment when you’re a...

How Entering a Higher Income Tax Bracket Affects Your Pay Cheque

How Entering a Higher Income Tax Bracket Affects Your Pay Cheque by Kelly Gabriel Income tax brackets in Canada can be a confusing subject....

Types of Credit Card Chargebacks & Why They Matter for Your Money

Types of Credit Card ChargebacksAnd Why They Matter for Your Money by Kevin Sun When used properly, credit card chargebacks are a powerful...

What Balancing Your Budget Really Means

What Balancing Your Budget Really Means by Kevin Sun What do you imagine when you think about a balanced budget? Do you see your budget as a...

Leasing vs Buying a New Car, What Is Better?

Leasing vs Buying a New Car, What Is Better? by Kelly Gabriel Whether you just got your driver’s license and are looking for a new car, have...

5 Things to Do After Getting a Pay Raise

5 Things to Do After Getting a Pay Raise by Kevin Sun Getting a raise feels good. Whether it comes from a performance review, a promotion, or...

Why You Should Know Your Financial Net Worth

Why You Should Know Your Financial Net Worth by Kevin Sun When’s the last time you chatted with friends about your financial net worth?...

4 Things to Do If You Owe CERB Taxes

4 Things to Do If You Owe CERB Taxes by Mark Kalinowski 2020 was an unusual year. Not only was there a great deal of anxiety around a global...

Time Is Money and Here Is How to Use Both Wisely

Time Is Money and Here Is How to Use Both Wisely by Kevin Sun Have you ever wondered if something you did to save some money was worth the...

4 Reasons to Join a Free Personal Finance Webinar

4 Reasons to Join a Free Personal Finance Webinar by Kevin Sun Everyone loves a good webinar, right? Well, maybe not, but if learning is one...

Tips to Save Money When Using Major Household Appliances

Tips to Save Money When Using Major Household Appliances by Julie Jaggernath If you’re like most Canadians, your household bills consume a...

How to Reduce Your Credit Card Debt This Year

How to Reduce Your Credit Card Debt This Year by Kevin Sun Now that last year is finally behind us, we all hope that a better new year will...

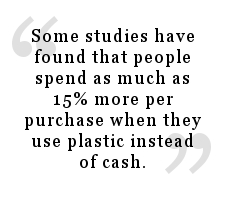

12 Tips to Use a Credit Card but Not End Up in Debt

12 Tips to Use a Credit Card But Not End Up in Debt by Julie Jaggernath Do you ever wonder how people without credit card debt do it? How do...

6 Ways Meal Planning Will Save You Money

6 Ways Meal Planning Will Save You Money by Julie Jaggernath Meal planning is a way to get yourself organized before you shop for groceries....

Top 10 Savings Tips for Financial Literacy Month

Top 10 Savings Tips for Financial Literacy Month Curated by the CCS Education Team We often get asked about the best ways to save. So to...

Financial Literacy Month 2020

Financial Literacy Month 2020 November 2020 is the 10th anniversary of Financial Literacy Month in Canada! This month, the Credit Counselling...

How to Help Friends or Family Save Money (Without Giving Them Any)

How to Help Friends or Family Save Money(Without Giving Them Any) By Kevin Sun Do you have family or friends who have trouble saving money?...

Subscription Costs: The Silent Spender & How to Stop the Damage

Subscription Costs:The Silent Spender & How to Stop the Damage By Kevin Sun and Mark Kalinowski Are subscription costs the reason why...

#LearnWithCCS: 5 Money Tips from Readers About Personal Finances

#LearnWithCCS: 5 Money Tips from Readers About Personal Finances In June, we asked readers across all of our social media channels for money...

Why Credit Card Balance Protection Insurance Isn’t Worth It

Why Credit Card Balance Protection Insurance Isn’t Worth It By Julie Jaggernath and Kevin Sun While getting balance protection insurance for...

Are You Missing Out If You Don’t Have a Credit Card?

Are You Missing Out If You Don’t Have a Credit Card? By Kevin Sun These days, it seems like everyone has a credit card. If you’ve never used...

Clean Up, Declutter, and Stop Spending Impulsively with Kakeibo: the Japanese Art of Saving Money

Clean Up, Declutter, and Stop Spending Impulsively with Kakeibo: The Japanese Art of Saving Money By Monika Ritchie Could your finances use...

3 Tips to Manage Video Game Costs

3 Tips to Manage Video Game Costs by Kevin Sun Spending on gaming has never been more complicated than it is today. Whether you’re a gamer...

Looking for Great Deals? Resist the Urge to Buy Impulsively

Looking for Great Deals? Resist the Urge to Buy Impulsively There's more to getting the best deals online or in-store than shopping for sale...

Plan Ahead to Avoid the Baby (Budget) Blues

Plan Ahead to Avoid the Baby (Budget) Blues By Monika Ritchie A brand-new person is always cause for joy, celebration, and spending. Lots of...

7 Ways to Save on Your Grocery Bill During the Coronavirus Pandemic

7 Ways to Save on Your Grocery Bill During the Coronavirus PandemicBy Monika Ritchie More Canadians than ever were already looking for ways to...

5 Ways to Go Green and Save Money on Earth Day

5 Ways to Go Green and Save Money on Earth DayToday, April 22, is Earth Day. To help promote Earth Day, we thought we would offer some tips on...

Managing Stress and Your Finances During the COVID-19 Pandemic

Managing Stress and Your Finances During the COVID-19 Pandemic By Monika Ritchie There’s no doubt that as we weather the coronavirus pandemic,...

Your Health and Well-being is More Important Than Your Credit Rating

Your Health and Well-being is More Important Than Your Credit Rating By Julie Jaggernath During this time of wide-spread income uncertainty it...

What Does It Mean to Build an Emergency Budget?

What Does It Mean to Build an Emergency Budget? By Julie Jaggernath An emergency budget is different than emergency savings. When your income...

How to Rebuild Your Credit Rating After Bankruptcy

How to Rebuild Your Credit Rating After Bankruptcy By Julie Jaggernath & Monika Ritchie Are you wondering how to rebuild your credit...

Adult Kids on a Spending Spree? 4 Reasons Why Not to Bail Them Out Financially

Adult Kids on a Spending Spree? 4 Reasons Why Not to Bail Them Out Financially By Julie Jaggernath We all know that "someone" – a sibling,...

Why You Don’t Want an Income Tax Refund Next Year

Why You Don’t Want an Income Tax Refund Next Year Q: My friend was all but bragging about how big her income tax refund is this year and all...

11 Ways to Pay for Your Education When Going Back to School

11 Ways to Pay for Your Education When Going Back to School By Julie Jaggernath If you’re a mature student looking to return to school,...

3 Secrets to Paying Off Credit Cards Fast

3 Secrets to Paying Off Credit Cards Fastby Scott Hannah Q: I have no trouble charging stuff on my credit cards, but paying them down, never...

The Year to Stop Ignoring Your Piggy Bank, Tips to Make Saving Easier

The Year to Stop Ignoring Your Piggy Bank, Tips to Make Saving EasierBy Julie Jaggernath How’s your piggy bank, aka your savings account,...

4 Credit Card Minimum Payment Myths – How to Avoid the Pitfalls

4 Credit Card Minimum Payment MythsHow to Avoid the Pitfalls By Julie Jaggernath Credit cards, those shiny pieces of plastic almost feel...

Turning Resolutions Into Results, Doing Step 3 Helps Ensure Success!

Turning Resolutions Into Results, Doing Step 3 Helps Ensure Success! By Julie Jaggernath Resolutions are one way me implement changes in our...

From Credit Cards to Christmas Debt, Which Bills to Pay First?

From Credit Cards to Christmas Debt, Which Bills to Pay First?By Carmen Chai By now Christmas credit card bills have arrived, and the holiday...

What Are Your Bad Habits Really Costing You?

What Are Your Bad Habits Really Costing You? By Julie Jaggernath We all like our habits, in fact, people in general are known to be creatures...

6 Smart Money Tips for the Holiday Season

6 Smart Money Tips for the Holiday Season By Julie Jaggernath Does it seem like the Christmas and holiday shopping season started earlier this...

Important Credit Card Jargon and Terms to Know

Important Credit Card Jargon and Terms to Know Although few people would likely compare personal finance to their favourite sport, the two...

Retirement at 75 or Saving for our Kids’ Education – Help!

Retirement at 75 or Saving for our Kids' Education - Help! By Scott Hannah Q: My partner and I are the proud and new parents of our first...

Are You Planning to Fund Your Retirement with a Big Win? Here are Our Top 5 Retirement Planning Tips

Are You Planning to Fund Your Retirement with a Big Win? Here are Our Top 5 Retirement Planning TipsFor everyone who's thinking about...

Don’t Just Wish to Own a Home – Alternatives to Make It Happen

Don’t Just Wish to Own a Home – Alternatives to Make It Happenby Scott Hannah Q: I’m a single professional earning a good income and I’ve been...

Is Getting a Student Loan Worth It or Not?

Is Getting a Student Loan Worth It or Not? By Scott Hannah Q: My older sister graduated university last year with a huge student loan. My...

The Hidden Dangers of Using a Line of Credit to Consolidate Debt

The Hidden Dangers of Using a Line of Credit to Consolidate Debt by Scott Hannah Q: I have two credit cards with outstanding balances of...

Do You Think of Savings as An Important Expense?

Do You Think of Savings as An Important Expense? By Julie Jaggernath We all know that someone. They don’t look like they’re living life on a...

How to Pay Debt Off Quickly – Proper Budgeting Tips for Paying Down Debt

How to Pay Debt Off QuicklyProper Budgeting Tips for Paying Down DebtBy Julie Jaggernath Have you hit a brick wall trying to find the best or...

Fastest Ways to Save Money for a Down Payment on a Home

Fastest Ways to Save Money for a Down Payment on a HomeUrban areas in some of Canada’s most popular cities have a serious rental shortage....

Debunking 5 Credit Myths and What to Do Instead

Debunking 5 Credit Myths and What to Do Instead The credit reporting system is one of the biggest mysteries for consumers when it comes to...

How to Take Control of Your Finances While in College, University, or Post-Secondary Trades or Technical School

How to Take Control of Your Finances While in College, University, or Post-Secondary Trades or Technical School Post by Madison Guy Is your...

Tips to Reduce Financial Stress and Cope Better

Tips to Reduce Financial Stress and Cope Better Q: I’m really worried about my brother and want to help him reduce financial stress in his...

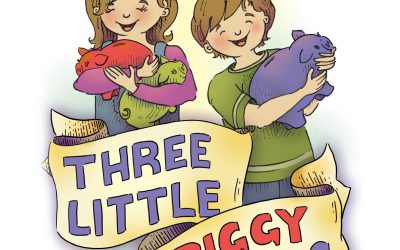

5 Reasons Why I Wrote a Financial Literacy & Money Management Book for Children

5 Reasons Why I Wrote a Financial Literacy & Money Management Book for Children Financial literacy, also known as money management, has gotten...

9 Smart Money Moves to Make in Your 20’s

9 Smart Money Moves to Make in Your 20's By Julie Jaggernath If you’re a 20-something, having paid even a bit of attention to your money and...

6 Tips to Help You Shop for a New or Used Car Like a Pro

6 Tips to Help You Shop for a New or Used Car Like a Pro By Julie Jaggernath Replacing your vehicle with a good used car or buying a new car...

Smart Back-to-School Shopping Tips That Can Save You Money

Smart Back-to-School Shopping Tips That Can Save You Money By Julie Jaggernath There’s no shortage of smart back-to-school shopping tips when...

Could You Survive a Financial Emergency Like a Forest Fire?

Could You Survive a Financial Emergency Like a Forest Fire?Q: My heart goes out to the tens of thousands of people in the interior of B.C. who...

How Much Rent Can I Afford? | A Canadian Perspective

How Much Rent Can I Afford? A Canadian Perspective If you're thinking about renting a place and are wondering "How much rent can I afford?",...

Five Credit Card Mistakes That Can Ruin Your Credit Rating

Five Credit Card Mistakes That Can Ruin Your Credit Ratingby Scott Hannah Q: My boyfriend and I have recently moved in together and we started...

New Surprising Things Most People Don’t Know about Life & Health Insurance

New Surprising Things Most People Don’t Know about Life & Health Insurance Life and health insurance are important tools to protect your...

Is a Free Credit Score Really Free?

Is a Free Credit Score Really Free? by Scott Hannah Q: My husband and I have recently paid off our student loan debts, so now we’re working on...

Top Five Money Principles Every Kid Needs to Know

Top Five Money Principles Every Kid Needs to Know by Scott Hannah Q: Before asking for your advice I want to come clean that my husband and I...

How to Get the Most Out of Your Income Tax Refund

How to Get the Most Out of Your Income Tax Refund by Scott Hannah Q: My partner and I usually don’t get tax refunds. However, last year we...

Payday Loans: What You Need to Know Before You Borrow

Payday Loans: What You Need to Know Before You Borrow by Scott Hannah Q: I’m embarrassed to admit that I’ve been struggling to pay off $500...

Serious About Paying Off Debt? Here are Three Things to Avoid

Serious About Paying Off Debt?Here are Three Things to Avoid by Scott Hannah Q: My partner and I were going over our credit card bills the...

5 Things You Can Do To Improve Your Credit Score

5 Things You Can Do To Improve Your Credit Score by Scott Hannah Q: I recently applied for a car loan but was told that because of some...

5 Smart Money Moves for 2017

5 Smart Money Moves for This Yearby Scott Hannah Q: I’ve been living paycheque to paycheque for years even though I make a good living as a...

How to Keep Your New Year’s Resolutions and Make Them Stick

How to Keep Your New Year’s Resolutions and Make Them StickBy Julie Jaggernath Do you make New Year’s resolutions? Maybe the start of a new...

5 Tips to Help You Save on Your Next Vacation

5 Tips to Help You Save on Your Next Vacationby Barry Choi Traveling is one of my favourite things to do. The experiences I’ve had while...

How to Restore Your Credit | Credit Restoration Help in Canada

How to Restore Your CreditCredit Restoration Help in Canada If you’re looking to clean up your credit and restore your credit score, you...

How to Tell When Gambling has Gone Too Far

How to Tell When Gambling has Gone Too FarBy Julie Jaggernath Gambling has never been more popular than in today's culture. Poker games are...

Skipping A Credit Card Payment Could Leave You Stranded & Owing More

Skipping A Credit Card Payment Could Leave You Stranded & Owing MoreQ: My friend and I are about to head down to Central America for a month...

4 Examples of Bad Personal Financial Advice & Why You Should Ignore It

4 Examples of Bad Personal Financial AdviceWhy You Should Ignore It Q: I’m a 48 year old single mother of three. My oldest son recently moved...

Hidden Maintenance Costs When Buying a New Car: Will They Blow Your Budget?

Hidden Maintenance Costs When Buying a New Car:Will They Blow Your Budget? Not knowing what you are looking for in a car is one of the worst...

7 Financial Mistakes to Avoid at University

7 Financial Mistakes to Avoid at UniversityQ: Our son is attending his first year of university and while we haven’t been able to set aside...

Financial Problems that Follow Social Media & How to Avoid Them

Financial Problems that Follow Social Media And How to Avoid Them Q: Every time I check my Instagram I see a friend showing off what they...

6 Personal Finance Moves to Make Before 30

6 Personal Finance Moves to Make Before 30Q: My daughter is in her mid-twenties and recently got out on her own for the first time. She’s...

College Or Trade School Vs University – Financially Speaking Which Is Better?

College Or Trade School Vs University - Financially Speaking Which Is Better? Q: Our son is in grade 10 and just completed a school project to...

Financial Crises Are Never Planned, They Just Happen

Financial Crises Are Never Planned, They Just HappenQ: I feel horrible for the people of Fort McMurray and can’t even begin to imagine what...

4 Ways to Tell If Reward Credit Cards are Worth It for You

4 Ways to Tell If Reward Credit Cards are Worth It for You By Julie Jaggernath Canadians are in love with their reward credit cards. Whether...

Paying Property Taxes – Avoid a Big Bill; Find a Good Option That Makes It Easier for You

Paying Property Taxes – Avoid a Big Bill; Find a Good Option That Makes It Easier for You By Julie Jaggernath Homeowners are required to pay...

How to Deal with Credit Card Debt – Advice from Last Year’s Self

How to Deal with Credit Card Debt – Advice from Last Year’s SelfBy Julie Jaggernath Have you ever made a conscious effort to pay down credit...

Where Do You Find the Money to Achieve a Financial Goal?

Where Do You Find the Money to Achieve a Financial Goal?by Scott Hannah Q: I set a goal to save up $3,000 by the end of the year and get away...

Is There Such a Thing as Good Debt & Is Living Debt Free Realistic?

Is There Such a Thing as Good Debt & Is Living Debt Free Realistic?by Scott Hannah Q: My partner and I have struggled to get our student loans...

Why Messing up Financially Might be Good for Your Adult Kids

Why Messing up Financially Might be Good for Your Adult Kids Q: I’ve got three adult children, two sons and a daughter, who are all in their...

The Benefits of Filing Your Personal Tax Return in Canada

The Benefits of Filing Your Personal Tax Return in Canadaby Julie JaggernathMaking Smart Financial Management Decisions Do you dread filing...

Tempted by a Credit Repair Company in Canada? How to Do Better for Free

Tempted by a Credit Repair Company in Canada? How to Do Better for Free A number of credit repair companies in Canada are trying to sell...

Money Habits of Successful People that You Can Copy and Do Too

Money Habits of Successful People that You Can Copy and Do TooQ: My girlfriend’s parents are well off, or even rich, but looking at them you’d...

How to Make Valentine’s Day Special Yet Affordable

How to Make Valentine's Day Special Yet Affordable Q: My wife drops little hints about February 14 as soon as we see heart shaped candy in the...

How to Save for Retirement in Canada on a Small Income

How to Save for Retirement in Canada on a Small Income By Debra Pangestu With numerous financial responsibilities to juggle and a big chunk of...

5 Signs You May Have a Debilitating Debt Problem

5 Signs You May Have a Debilitating Debt Problem Life is a constant stream of financial incomings and outgoings, and it can be difficult to...

How to Turn New Year’s Resolutions into Results

How to Turn New Year's Resolutions into Results Q: My friends and I all make resolutions on January 1st but most of us don’t end up sticking...

9 Common Money Mistakes to Stop Making in Your 30’s

9 Common Money Mistakes to Stop Making in Your 30'sBy Debra Pangestu Having money problems is something a lot of us encounter during our 20’s...

Managing Money and Debt Wisely

Managing Money and Debt WiselyBy Jane Rooney, Canada's Financial Literacy Leader Financial Literacy Month (FLM) is in its fifth year and I am...

5 Money Saving Tips to Survive a Recession

5 Money Saving Tips to Survive a Recession With rising debt levels, fluctuating markets and dropping oil prices, having some money saving tips...

Money Making Tricks to Offset Your Mortgage

Money Making Tricks to Offset Your Mortgage For most of us, housing is our biggest expense. When you own your own home or condominium, you...

When Leasing a Car is Good & When It’s One of the Worst Things You Can Do

When Leasing a Car is Good & When It's One of the Worst Things You Can DoQ: My husband and I don’t know if we should buy or lease a new...

25 Frugal Living Ideas So You Can Save Money and Pay Off Debt

25 Frugal Living Ideas So You Can Save Money and Pay Off Debt By Debra Pangestu One of the keys to gain control of your finances and pay off...

Ways to Save Money for a Financial Goal in 5 Steps That Everyone Can Do

Ways to Save Money for a Financial Goal in 5 Steps that Everyone Can Do By Julie Jaggernath Is there something you’d like to buy but can’t...

The Secrets Behind Personal Debt Consolidation Loans in Canada

The Secrets Behind Personal Debt Consolidation Loans in Canada If you're try to get a personal debt consolidation loan, you may have noticed...

How to Fix & Improve Your Credit Score for Free & Refresh Financial Picture

How to Fix & Improve Your Credit Score for Free & Refresh Financial Picture If you'd like to learn how to fix and improve your credit for free...

8 Easy, Low-Cost Home Improvements You Can Do in One Weekend to Save Money on Your Household Bills

8 Easy, Low-Cost Home Improvements You Can Do in One Weekend to Save Money on Your Household Bills By Julie Jaggernath Whether you’re a...

How to Start Planning for Christmas in July – Avoid Financial Problems with Large or Unexpected Expenses

How to Start Planning for Christmas in JulyAvoid Financial Problems with Large or Unexpected ExpensesBy Julie Jaggernath Do you ever wonder...

7 Steps to Saving Money in an Emergency Fund

7 Steps to Saving Money in an Emergency Fund By Debra Pangestu Emergencies and unexpected expenses can strike when you least expect, and it’s...

Couples and Money: 5 Common Money Mistakes Couples Make & How to Fix Them Without Fighting | Managing Marriage Problems

5 Common Money Mistakes Couples Make & How to Fix Them Without FightingManaging Marriage Problems By Debra Pangestu Openly discussing...

How to Overcome 8 Sources of Financial Problems & Difficulties

How to Overcome 8 Sources of Financial Problems & Difficulties Protect Yourself from a Financial Crisis or Emergency Financial problems and...

How to Stop Spending Money: 7 Tips and Tricks to Curb Your Overspending

How to Stop Spending Money7 Tips and Tricks to Curb Your Overspending By Debra Pangestu Have you ever started off the month with the best of...

How to Reduce Debt in Ontario

How to Reduce Debt in Ontario The elevated household debt levels in Canada are causing many Ontarians to wonder how to reduce debt in Ontario....

5 Personal Finance Tips Most People Wish They’d Known When They Were Younger

5 Personal Finance Tips Most People Wish They’d Known When They Were Younger by Scott Hannah Q: Our daughter is 15 and has an assignment for...

“Government Approved” Credit Card Debt Consolidation Programs in Canada

“Government Approved” Credit Card Debt Consolidation Programs in CanadaWe’ve noticed that a number of debt relief and debt consolidation...

Are You Making These 6 Big Money Mistakes? Here’s How to Avoid Them

Are You Making These 6 Big Money Mistakes? Here’s How to Avoid ThemBy Scott Hannah Q: I’m in my early 30’s and have recently ended a...

Financial Hardship Reasons for Unlocking Locked In RRSP – Withdrawal of Pension Funds | Canada

Financial Hardship Reasons for Unlocking Locked In RRSPWithdrawal of Pension Funds | Canada Locked-In RRSP Retirement Funds Can Be Unlocked...

6 Step Plan to Spring Cleaning and Organizing Your Finances

6 Step Plan to Spring Cleaning and Organizing Your Finances By Debra Pangestu An important part of keeping your personal finances in good...

I Just Got Paid, But Where Did My Money Go? 5 Steps to Help Track Your Spending

I Just Got Paid, But Where Did My Money Go? 5 Steps to Help Track Your Spending By Scott Hannah Q: I don’t live an extravagant lifestyle, yet...

6 Things Millennials Can Do to Buy a House within the Next Decade

6 Things Millennials Can Do to Buy a House within the Next Decade By Scott Hannah Q: Is home ownership a reality for Millennials? Like a lot...

Financial Hardship Assistance, Programs, Info & Help

Financial Hardship Assistance, Programs, Info & HelpWhat is a Financial Hardship? – Definition A financial hardship is when someone is willing...

Buying a House – 6 Things No One Tells You, Including How Much of a Mortgage You Can Afford

Buying a House - 6 Things No One Tells You, Including How Much of a Mortgage You Can Afford By Julie Jaggernath Ever wonder what no one tells...

5 Things You Need to Do to Live on One Income Successfully

5 Things You Need to Do to Live on One Income Successfully By Scott Hannah Q: We are having trouble finding affordable daycare for our two...

4 Smart Money Management Tips – How #theDress Relates to Personal Finances

4 Smart Money Management TipsHow #theDress Relates to Personal Finances By Julie Jaggernath No matter how you look at #theDress, whether you...

3 Ways to Get Out of Overdraft Protection Once and For All

3 Ways to Get Out of Overdraft Protection Once and For AllBy Christi Posner If you’ve been living in overdraft protection for quite some time,...

Where to Find Bad Credit Debt Help in Canada

Where to Find Bad Credit Debt Help in Canada When you have bad credit, many times either no one wants to help you with your debt, or if they...

How to Solve Money Problems on Your Own

How to Solve Money Problems on Your Own If you want to know how to solve money problems on your own, we can show you. There are many reasons...

How to Find the Best Debt Help Advice

How to Find the Best Debt Help Advice Across Canada there are hundreds of companies offering debt help advice to consumers for everything from...

3 Bad Money Mistakes People Make When They Have Too Much Debt & How to Solve These Financial Problems

3 Bad Money Mistakes People Make When They Have Too Much Debt & How to Solve These Financial ProblemsBy Julie Jaggernath When it feels like...

In Canada People with Bad Credit May Have Better Options than Getting a Costly Personal Loan

In Canada People with Bad Credit May Have Better Options than Getting a Costly Personal LoanIf you live in Canada and you’ve been turned down...

How to Find Canada’s Best Debt Help Services

How to Find Canada’s Best Debt Help ServicesWhen it comes to people and companies offering debt help services in Canada, everyone claims they...

Top 5 Solutions When You Are Declined for a Debt Consolidation Loan

Top 5 Solutions When You Are Declined for a Debt Consolidation Loan In a previous article, we laid out the top five reasons why people are...

How to Find the Best Consumer Credit Counselling Services

How to Find the Best Consumer Credit Counselling Services With so many consumer credit counselling services offering debt help and advice, how...

Get a Free Financial Assessment from a Non-Profit Credit Counselling Organization

Get a Free Financial Assessment from a Non-Profit Credit Counselling OrganizationBy Christi Posner A free financial assessment from a credit...

The Cure to Bad Credit Debt Consolidation Loans for People Struggling with a Poor Credit Rating

The Cure to Bad Credit Debt Consolidation Loans for People Struggling with a Poor Credit Rating If you are looking for a bad credit debt...

Top 5 Reasons People are Declined for Debt Consolidation Loans

Top 5 Reasons People are Declined for Debt Consolidation LoansWhen people begin to experience financial difficulty, they often look at debt...

How To Live On a Budget

How To Live On a Budget By Christi Posner If you’re ready to start living on a budget, this is your all inclusive guide! Whether you want to...

How to Fix Bad Credit and Get Out of Debt Without a New Bad Credit Loan

How to Fix Bad Credit and Get Out of Debt Without a New Bad Credit Loan By Christi Posner Even if you have tons of debt in collections, there...

Is it Worth Shopping in the States to Get a Good Deal?

Is it Worth Shopping in the States to Get a Good Deal?By Julie Jaggernath Canadian retailers are again anticipating a busy holiday shopping...

Did You Know That an Expense Tracker Can Solve All of Your Budget Planning Problems?

Did You Know That an Expense Tracker Can Solve All of Your Budget Planning Problems?By Christi Posner If you’ve tried budgeting and failed...

Help, I’m Being Sued! What To Do When You Receive a Notice of Claim for a Debt

Help, I’m Being Sued!What To Do When You Receive a Notice of Claim for a Debt By Clare Smith You know you’re being sued for a debt when you...

How to Live on a Budget with a Paycheque Planner

How to Live on a Budget with a Paycheque PlannerBy Christi Posner Paycheque planners make learning how to live on a budget a breeze! Imagine...

How to Save Electricity and Save Money on Your Energy Bill

How to Save Electricity and Save Money on Your Energy BillBy Christi Posner Discovering how to save electricity around the house can help you...

Organize Your Bank Accounts in 3 Easy Steps – Fixed, Savings, and Variable Expenses

Organize Your Bank Accounts in 3 Easy StepsFixed, Savings, and Variable Expenses By Christi Posner Once you've created a balanced budget for...

How to Save Money On Your Household Bills & What To Do With It Once You’ve Started Saving Money – Part 5

How to Save Money On Your Household Bills & What To Do With It Once You’ve Started Saving Money - Part 5 By Christi Posner Learning how to...

What are Fixed, Savings and Variable Costs and Expenses, and How Will They Help Me Learn How to Budget My Money Properly?

What are Fixed, Savings, and Variable Costs and Expensesand How Will They Help Me Learn How to Budget My Money Properly? By Christi Posner...

Free Campaigns to Help You Save Electricity and Money – Part 4, BC Hydro, Enmax, SaskPower, Manitoba Hydro, Hydro One and More

Free Campaigns to Help You Save Electricity and MoneyPart 4, BC Hydro, Enmax, SaskPower, Manitoba Hydro, Hydro One and MoreBy Christi Posner...

This Free Budget Calculator Spreadsheet Teaches You How to Budget and Get Out of Debt

This Free Budget Calculator Spreadsheet Teaches You How to Budget and Get Out of Debt By Christi Posner As both a Credit Counsellor and a...

Tips to Save Money on Your Household Electricity & Energy Bill – Part 3, Electronics, Computers, Laptops and Lighting

Tips to Save Money on Your Household Electricity & Energy BillPart 3, Electronics, Computers, Laptops and LightingBy Christi Posner We’ve got...

Avoiding the Summer-Time Blues – How to Afford a Summer Vacation When Money is Tight

Avoiding the Summer-Time BluesHow to Afford a Summer Vacation When Money is TightGetting away during the summer months for a much needed...

10 Tips for Paying Off Credit Card Debts

10 Tips for Paying Off Credit Card DebtsBy Christi Posner Ready to pay off your credit card debts? Here are some practical ways you can...

More Ways to Save Money on Your Household Electricity Bill – Part 2, Furnace, Air Conditioner and Hot Water Tank

More Ways to Save Money on Your Household Electricity BillPart 2, Furnace, Air Conditioner and Hot Water Tank By Christi Posner Here’s Part 2...

What To Do Before Reduced Income Happens – Debt Help, Saving Money, Tracking Expenses, Budgeting and Credit

What To Do Before Reduced Income HappensDebt Help, Saving Money, Tracking Expenses, Budgeting and Credit By Christi Posner Suddenly facing...

8 Common Money Mistakes that Can Keep You Broke | Biggest Mistakes to Avoid that Almost Everyone Makes

8 Common Money Mistakes that Can Keep You BrokeBiggest Mistakes to Avoid that Almost Everyone MakesMany people wonder why they never seem to...

How to Save Money on Your Household Energy & Electricity Bill – Part 1, Washers & Dryers, Dishwashers, Fridges, Freezers and Ovens

How to Save Money on Your Household Energy & Electricity BillPart 1, Washers & Dryers, Dishwashers, Fridges, Freezers and Ovens By Christi...

How Do Parking Tickets Affect Your Credit Rating? | How to Get Them Removed

How Do Parking Tickets Affect Your Credit Rating? How to Get Them Removed Old, unpaid parking tickets can haunt you and your credit report You...

“Throwback Thursday” and Paying Off Debt – What Can the Social Media Game and Web Trend Reveal?

"Throwback Thursday" and Paying Off DebtWhat Can the Social Media Game and Web Trend Reveal? By Julie Jaggernath You might have seen or played...

Many People Can’t File for Bankruptcy in Canada and Need Alternatives

Many People Can’t File for Bankruptcy in Canada and Need Alternatives By Christi Posner One of the biggest bankruptcy myths in Canada is that...

How to Prepare for Unexpected Expenses With a Budget & Money Management Plan

How to Prepare for Unexpected Expenses With a Budget & Money Management PlanBy Julie Jaggernath Winter came in with a vengeance this year. It...

3 Lessons from a Leprechaun About Saving, Using Credit Wisely and Being Debt Free

3 Lessons from a Leprechaun About Saving, Using Credit Wisely and Being Debt FreeBy Julie Jaggernath If you could trap a tricky little...

5 Signs Your Finances are Headed for Trouble

5 Signs Your Finances are Headed for Trouble When you think about how much you earn, the type of vehicle you drive or all of the great stuff...

How to Find the Best Certified Financial Planner (CFP) or Financial Advisor for Help with Managing Money, Retirement Planning or Wealth Management | Personal Finances

How to Find the Best Certified Financial Planner (CFP) or Financial Advisor for Help with Managing Money, Retirement Planning or Wealth...

4 Common Credit Report & Credit Score Problems & How to Fix Them

4 Common Credit Report ProblemsAnd How to Fix ThemPeople often ask how they can fix their credit report or credit score. Depending on your...

What Does a Groundhog Know About Money? | Save, Set Goals & Plan

What Does a Groundhog Know About Money?Save, Set Goals & Planby Julie Jaggernath Wouldn’t it be great to roll out of bed in the morning and...

Is Winning the Lottery Part of Your Financial Plan?

Is Winning the Lottery Part of Your Financial Plan?by Julie Jaggernath When you hear that the lotto jackpot is bigger than usual, do you buy...

How to Save Money and Plan Ahead for Christmas Shopping, Holiday Spending and New Year’s Resolutions

How to Save Money and Plan Ahead for Christmas Shopping, Holiday Spending and New Year’s ResolutionsWhether you and your family stay close to...

Manage Christmas and Holiday Season Stress to Avoid Maxing Out Your Credit Cards

Manage Christmas and Holiday Season Stress to Avoid Maxing Out Your Credit Cards by Julie Jaggernath With only two weeks before Christmas, you...

‘Twas the Week Before Christmas | Avoid Holiday Debt with a Budget & Spending Plan

'Twas the Week Before ChristmasAvoid Holiday Debt with a Budget & Spending Plan by Julie Jaggernath Santa has some secrets for avoiding...

Why is My Available Balance Higher Than My Bank Account Balance? | How Overdraft Protection Really Works

Why is My Available Balance Higher Than My Bank Account Balance?How Overdraft Protection Really Worksby Julie Jaggernath It's interesting what...

3 Ways to Create a Personal Budget Plan with Irregular Income

3 Ways to Create a Personal Budget Plan with Irregular Income by Julie Jaggernath When you're a student with a student loan, a self-employed...

Financial Literacy Month Events for November 2013

Financial Literacy Month Events for November 2013November is Financial Literacy Month in Canada and the Credit Counselling Society is excited...

Scary Good Money Ideas – How to Manage Money Better and Get Out of Debt

Scary Good Money IdeasHow to Manage Money Better and Get Out of Debt by Julie Jaggernath Do your financial facts frighten you? Maybe you’re...

Survey Says that Three-Quarters of Canadians Don’t Save Up for Holiday Shopping

Survey Says that Three-Quarters of Canadians Don’t Save Up for Holiday Shoppingby Julie Jaggernath According to a recent survey conducted by...

Do You Live In a Financial Danger Zone? | How to Stop Living Pay Cheque to Pay Cheque

Do You Live In a Financial Danger Zone?How to Stop Living Pay Cheque to Pay Chequeby Julie Jaggernath Are you living pay cheque to pay cheque...

Wedded Bliss Not Wedding Bills – Start Your Married Life Without Debt

Wedded Bliss Not Wedding BillsStart Your Married Life Without Debtby Julie Jaggernath Getting engaged is an exciting time for any couple,...

The 5 Most Important Things Young Adults & Grads Can Do for Their Finances

The 5 Most Important Things Young Adults & Grads Can Do for Their Finances by Julie Jaggernath Transitioning from the life of going to...

Back to School Tips – How to Balance Your Budget with Needs and Wants

Back to School TipsHow to Balance Your Budget with Needs and Wantsby Julie Jaggernath Tips to help you make smart spending choices as you shop...

Solutions for Credit and Debt Problems Canada – Detroit Bankruptcy Takeaways

Solutions for Credit and Debt Problems CanadaDetroit Bankruptcy Takeaways by Julie Jaggernath Whether it’s an entire American city, or an...

25 Budget Grocery Shopping Tips to Save Money

25 Budget Grocery Shopping Tips to Save Money By Julie Jaggernath Have you noticed how much of your overall budget you spend on groceries?...

Budget Planning for Kids & Teens Getting Their First Pay Cheques

Budget Planning for Kids & Teens Getting Their First Pay Chequesby Julie Jaggernath Do you have a teen who is starting to get their first real...

Inheritance Dilemma – Save & Invest or Pay Off Debt | Plan for Retirement

Inheritance Dilemma – Save & Invest or Pay Off DebtPlan for RetirementQ: We’ve just received $250,000 from an inheritance. This is enough to...

30 Ideas for Summer Fun, Staycation Style

30 Ideas for Summer Fun, Staycation Style Staycations have gained in popularity these past few years. Whether you don't want to go away for...

How to Start Planning for Christmas in July

How to Start Planning for Christmas in Julyby Julie Jaggernath Christmas is coming! Ok, it’s not worth sounding the alarm quite yet – it’s...

Fast Payday Loan and Quick Cash Advance Help Across Canada

Fast Payday Loan and Quick Cash Advance Help Across CanadaIf you feel as though you’re stuck in a payday loan cycle, you need to know that...

Does Being Organized with Money and Finances Really Matter?

Does Being Organized with Money and Finances Really Matter? by Julie Jaggernath Being organized with money and finances is about more than...

Managing Money and a Line of Credit When You’re Self-Employed

Managing Money and a Line of Credit When You're Self-EmployedQ: I was at the bank with my wife trying to get pre-approved for a new mortgage,...

Are Reward Credit Cards Really Worth It?

Are Reward Credit Cards Really Worth It?A lot of people these days are asking, "Are credit cards rewards cards really worth it?" When credit...

30-Day Savings Challenge | Affordable Summer Vacation Ideas

30-Day Savings Challenge Affordable Summer Vacation Ideas by Julie Jaggernath Have you ever tried a 30-day savings challenge? With only about...

Gas Prices and Storage Lockers – Part 3: Spring Cleaning Your Finances by Sorting & Getting Organized

Gas Prices and Storage LockersPart 3: Spring Cleaning Your Finances by Sorting & Getting Organizedby Julie Jaggernath We’re looking for more...

Use an Income Tax Refund to Pay Debt or Save for Emergencies

Use an Income Tax Refund to Pay Debt or Save for EmergenciesBy Julie Jaggernath Does getting an income tax refund feel like a windfall? No...

Avoid Credit Card Debt & Save Money on Groceries – Part 2: More Ways to Clean Up Your Finances this Spring

Avoid Credit Card Debt & Save Money on GroceriesPart 2: More Ways to Clean Up Your Finances this Springby Julie Jaggernath Here’s Part 2 in...

Bank Account, Cable, Internet and Cell Phone Fees, Plans & Charges – Part 1: Easy Ways to Clean Up Your Finances this Spring

Bank Account, Cable, Internet and Cell Phone Fees, Plans & ChargesPart 1: Easy Ways to Clean Up Your Finances this Springby Julie Jaggernath...

Check Reviews for Limited Complaints of Consumer Debtor Protection Companies in Canada

Check Reviews for Limited Complaints of Consumer Debtor Protection Companies in CanadaConsumer debtor protection companies in Canada - Before...

5 Steps to Get Out of Debt – Small Payments Make It Easier to Pay Off Debt

5 Steps to Get Out of Debt Small Payments Make It Easier to Pay Off Debt by Julie Jaggernath Think of a big project that you’ve been meaning...

5 Strategies for Getting Control of Your Money

5 Strategies for Getting Control of Your Money Overcoming Bad Money Habits Getting on the road to financial success is within your reach. If...

Consolidating Credit Card Bill Payments & Debt Solutions are Available Across Canada

Consolidating Credit Card Bill Payments & Debt Solutions are Available Across CanadaAre you interested in consolidating credit card payment...

Alternatives to Bankruptcy in Canada

Alternatives to Bankruptcy in CanadaBefore Declaring Personal Bankruptcy Check Out Your Other Options In Canada personal bankruptcy is often...

Non-Profit Credit Card Debt Help & Relief are Available Across Canada

Non-Profit Credit Card Debt Help & Relief are Available Across CanadaWith so many companies advertising that they can help your with your debt...

How to Break the RRSP Loan Cycle | Invest in RRSPs Without Borrowing

How to Break the RRSP Loan CycleInvest in RRSPs Without BorrowingQ: Every year when I hear the RRSP deadline ads, I head into the bank, take...

Staying Home for Spring Break? Kids Just Want to Have Fun

Staying Home for Spring Break? Kids Just Want to Have Funby Julie Jaggernath Spring Break is a mere few weeks away and if you’ve got...

How to Keep Valentine’s Day Affordable

How to Keep Valentine's Day Affordable by Julie Jaggernath How do you celebrate Valentine’s Day with your spouse or the special people in your...

How a Penny or Single Coin Can Motivate You to Save & Change Habits | Manage Money Better

How a Penny or Single Coin Can Motivate You to Save & Change HabitsManage Money Better by Julie Jaggernath Do you remember the old rhyme, “See...

How to Talk to Your Spouse About Setting Financial Goals | Money & Relationships

How to Talk to Your Spouse About Setting Financial Goals | Money & Relationshipsby Julie Jaggernath Do you talk about money and financial...

Keep Home Renovation Costs from Breaking Your Budget

Keep Home Renovation Costs from Breaking Your Budget Home renovation costs can be hard for anyone’s budget. Maybe you’re planning to live in...

How Can Savings Help You Stick to Your Plan to Pay Off Debt?

How Can Savings Help You Stick to Your Plan to Pay Off Debt?Q: I’m having a hard time paying down my debts and staying within my budget. I pay...

Money for Something… A Plan for Spending Gift Money

Money for Something… A Plan for Spending Gift Money by Julie Jaggernath Did your teens receive money or gift cards during the holidays? Have...

How to Build New Year’s Goals & Plans

How to Build New Year's Goals & PlansQ: Another year has gone by and my wife and I are frustrated that we can’t seem to get ahead financially....

Changing Resolutions to Solutions – The Debt Free Diet that Works

Changing Resolutions to SolutionsThe Debt Free Diet that WorksHave you made any New Year's resolutions? Many people plan to shed the extra...

Dashing Through the Malls…

Dashing Through the Malls...If your Christmas and holiday shopping is more about juggling your credit cards, budget and shopping bags, than...

How to Avoid a Holiday Hangover of Debt

How to Avoid a Holiday Hangover of Debt by Julie Jaggernath Nothing will ruin Christmas and holiday memories faster than a debt hangover in...

Financial Literacy Month 2012 Student Essay Contest Winners

Financial Literacy Month 2012 Student Essay Contest WinnersWe were overwhelmed with how many creative, funny and interesting submissions we...

‘Tis a Month Before Christmas, What Not to Forget

'Tis a Month Before Christmas, What Not to Forgetby Julie Jaggernath This can be an expensive time of year, whether you celebrate Christmas,...

How People Get Caught by Joint Debts

How People Get Caught by Joint DebtsHere is a common scenario: a couple splits up, gets a separation agreement and then one of them tries to...

Myth: “Credit card companies wouldn’t send me applications in the mail if I couldn’t afford another credit card.”

Myth: “Credit card companies wouldn't send me applications in the mail if I couldn't afford another credit card.” Just because a credit card...

How to Use a Balanced Approach to Pay Off Debt & Invest in RRSPs

How to Use a Balanced Approach to Pay Off Debt & Invest in RRSPs When faced with the choice of paying down high interest debt or investing in...

How to Weather the Financial Storms of Life | Preparing for Financial Problems

How to Weather the Financial Storms of LifePreparing for Financial ProblemsQ: A lot has happened this year to cause me to reflect about how...

How Electronic Banking is Safe | What Is Your Money’s Biggest Threat?

How Electronic Banking is SafeWhat Is Your Money’s Biggest Threat?by Julie Jaggernath Almost everyone these days uses some form of electronic...

4 Reasons Why Couples Argue About Money

4 Reasons Why Couples Argue About Money by Julie Jaggernath Many couples find it hard to talk about money. Some try, but it often turns into...

How to Start Talking with Your Spouse About Money

How to Start Talking with Your Spouse About Money by Julie Jaggernath Money issues are hard on a relationship and if not solved, can and do...

12 Weeks and Counting… Are You Expecting Too?

12 Weeks and Counting... Are You Expecting Too?by Julie Jaggernath I couldn’t believe what my friends were telling me. It’s official – they...

Teens and Cell Phones | How to Choose a Cell Phone Plan

Teens and Cell PhonesHow to Choose a Cell Phone PlanBy Julie Jaggernath Countless parents are confronted with the same question each week,...

Financial Literacy Month Events for November 2012

Financial Literacy Month Events for November 2012 Financial Literacy Month is in November and the Credit Counselling Society is excited to...

How to Pay for College or University without Getting into Major Debt

How to Pay for College or University without Getting into Major DebtQ: I recently finished my first year at college. I had too much fun being...

How to Decide if You Can Afford Another Payment in Your Budget or Not

How to Decide if You Can Afford Another Payment in Your Budget or NotQ: Each summer we enjoy time with our friends on their boat. After a...

Help! Our Home Equity is All Used Up, Now What?

Help! Our Home Equity is All Used Up, Now What?Q: We’ve always used our line of credit to pay our bills and credit cards, and then we’d...

How to Make Credit Card Rewards Work for You

How to Make Credit Card Rewards Work for YouQ: We collect points on our credit cards to help pay for our vacation costs but sometimes it can...

How to Tell If Your Father’s Day Gift Idea is Good Enough

How to Tell If Your Father’s Day Gift Idea is Good Enoughby Julie Jaggernath By their own choice, my kids don’t spend a lot of time watching...

What Are Your Plans for Your Kids This Summer? 5 Tips to Make Planning Easier

What Are Your Plans for Your Kids This Summer?5 Tips to Make Planning Easierby Julie Jaggernath It’s that time of year: kids are counting the...

How to Tell If You’re Ready for a Mortgage – What You Can Realistically Afford

How to Tell If You're Ready for a MortgageWhat You Can Realistically Affordby Julie Jaggernath Make a budgeting plan with monthly expenses in...

What to Do If You’re Trying to Decide If You Should File a Consumer Proposal

What to Do If You're Trying to Decide If You Should File a Consumer ProposalIf you are looking for information about filing a consumer...

What do you do when you and your partner don’t see eye to eye about money? | Spender vs. Saver Spouses

What Do You Do When You and Your Partner Don't See Eye to Eye About Money?Spender vs. Saver Spouses Q: My husband and I argue about money, but...

5 Tricks to Keep Your Cash Safe from Yourself | How to Control Spending

5 Tricks to Keep Your Cash Safe from YourselfHow to Control Spending Q. Every time there’s a “special event,” my friends like to have a pub...

How to Clear the Financial Clutter When Filing Your Income Taxes

How to Clear the Financial Clutter When Filing Your Income TaxesQ. One of our resolutions this year was to file our taxes early, rather than...

Facing Reduced Income… Now What?

Facing a Pay Cut or Reduced Income?Here’s What to Do Right NowFacing a pay cut is scary, but when you know it’s going to happen, how you get...

Balancing Spending on the Kids after Divorce

Balancing Spending on the Kids after DivorceQ: I’m a recently single mom of three. My ex and I both work and I receive support for the two...

Avoid Freedom 85 – Tips to Retire Debt Free

Avoid Freedom 85 Tips to Retire Debt Free By Julie Jaggernath High consumer debt levels, possible interest rate changes at any time,...

Should I Save for My Future or Pay Off My Student Loans?

Should I Save for My Future or Pay Off My Student Loans? What Should You Focus on: Getting Out of Debt or Saving for the Future? When it comes...

Credit & Debtors Agency With Advocates for Consumer Protection Canada

Credit & Debtors Agency With Advocates for Consumer Protection CanadaThe Canadian economy has slowed down, and many people who call themselves...

Credit & Debt Financial Counselling & Consolidation Services in Canada

Credit & Debt Financial Counselling & Consolidation Services in Canadaby Julie Jaggernath When financial trouble strikes, many people don’t...

How to Manage the Ever Increasing Cost of Living – Focus on What You Can Control

How to Manage the Ever Increasing Cost of Living – Focus on What You Can Control Q: My wife and I have good incomes and together we’re able to...

How to Keep Your Resolution to Shed Your Debt Weight & Get Out of Debt

How to Keep Your Resolution to Shed Your Debt Weight & Get Out of DebtQ. My resolution to pay off my credit cards in 2011 only lasted until...

Awesome New Car Offers & Incentives May Not be so Awesome for Your Finances

Awesome New Car Offers & Incentives May Not be so Awesome for Your Finances Q: I’m a little behind on my bills because I’ve had to sink money...

How to Protect Yourself from Fraud if You have been a Victim of Identity or Credit Card Theft in Canada

How to Protect Yourself from Fraud if You have been a Victim of Identity or Credit Card Theft in CanadaQ: I had my wallet stolen from my car...

How to Avoid Debt and Financial Problems when Purchasing a New Car

How to Avoid Debt and Financial Problems when Purchasing a New CarIt’s that time of year again – car clearing season; and the ads are...

How to Get a Better Handle on How You Use Credit

How to Get a Better Handle on How You Use CreditQ: Our daughter is in high school. She came home with an assignment to learn about credit and...

How to Improve Your Credit Rating (Credit Score) in Canada While Staying Out of Debt

How to Improve Your Credit Rating (Credit Score) in Canada While Staying Out of Debt Q: I’ve had trouble finding steady work these last few...

Canadian Snowbird Checklist

Canadian Snowbird ChecklistMany Snowbirds look forward to sunshine and warm temperatures in the winter months – it’s a big drawing card for...

How to Deal with Financial Infidelity

How to Deal with Financial InfidelityQ: I suspected my wife of having secret debt, so I confronted her. She confessed that she’s been carrying...

Is Your First Credit Card Getting Out of Control? Here’s How to Get Yourself Back on Track

Is Your First Credit Card Getting Out of Control? Here’s How to Get Yourself Back on TrackQ: I’m a first year university student and during...

How to Get Out of Debt Quickly – for Those Nearing Retirement

How to Get Out of Debt Quickly – for Those Nearing RetirementQ: My husband and I are hoping to retire in about 10 years. After meeting with...

How to Help Your Child Learn Money Management Skills after Graduation

How to Help Your Child Learn Money Management Skills after GraduationQ: Our oldest daughter recently graduated from high school and she’s not...

Pay Day Loan Help Available Across Canada

Pay Day Loan Help Available Across CanadaIf you or someone you know is struggling with pay day loans and is looking for a way to get their...

How to Keep from Getting Ripped Off by Debt Settlement & Debt Relief Scams in Canada

How to Keep from Getting Ripped Off by Debt Settlement & Debt Relief Scams in CanadaQ: I keep getting telephone messages from a company that...

How to Get Out of Debt – A Canadian Overview

How to Get Out of Debt - A Canadian OverviewThe First Step to Get Out of Debt - Get Organized To get out of debt, start by making a complete...

3 Steps to Pay Off Debt Before Interest Rates Rise

3 Steps to Pay Off Debt Before Interest Rates RiseBy Julie Jaggernath Take advantage of low interest rates to pay off debt faster....

Advantages of Consolidating Debt with a Non-Profit Debt Consolidation Service

Advantages of Consolidating Debt with a Non-Profit Debt Consolidation ServiceIf you’ve been declined for a loan by your bank or credit union...

What to Consider Before Buying a Vacation Property or Vacation Rental Home

What to Consider Before Buying a Vacation Property or Vacation Rental HomeBy Julie Jaggernath When our friends came home from holidays wanting...

How to Help Friends Who Need Help with Their Financial Problems

How to Help Friends Who Need Help with Their Financial Problems Q: We are friends with another couple in our neighbourhood. Despite having...

How to Plan a Vacation on a Budget

How to Plan a Vacation on a BudgetQ: Our two weeks of summer vacation time are fast approaching and we haven’t planned a thing. While we can’t...

The Cost of Living is Increasing – How to Protect Yourself from Inevitable Higher Costs of Living

The Cost of Living is Increasing – How to Protect Yourself from Inevitable Higher Costs of LivingQ: We bought our first home a few years ago...

The Catch Behind Daily Email Deals: Impulse Spending

The Catch Behind Daily Email Deals Impulse Spending Q: My friends have been taking advantage of those daily group email offers. I’ve signed up...

Vortex Debt Group is now Synergy Debt Group, Clear Blue Debt Solutions and Wav Services Team

Vortex Debt Group is now Synergy Debt Group, Clear Blue Debt Solutions and Wav Services TeamPublished: June 11, 2011 Update: Since this...

The Most Effective Ways to Manage the Rising Cost of Gas

The Most Effective Ways to Manage the Rising Cost of GasBy Scott Hannah Q. Like a lot of busy families we play taxi for our kids outside of...

Canadian Debt Settlement Company Reviews, Complaints, and Scams

Canadian Debt Settlement Company Reviews, Complaints, and Scams How to Tell if a Canadian Debt Settlement Company is Trying to Help You or...

How to Decide if Bankruptcy is Your Best Option to Debt Problems

How to Decide if Bankruptcy is Your Best Option to Debt Problems Q: I have an employee who has been very stressed at work lately. I spoke with...

How to Approach Asking Your Adult Child to Pay Rent

How to Approach Asking Your Adult Child to Pay Rent Q: My son is graduating in June and has just informed us that he plans to work for a year...

3 Tips for Solving Money and Family Budget Arguments

3 Tips for Solving Money and Family Budget Arguments Just as it’s normal to love your family, it’s normal to argue with them about money. An...

How to Protect Yourself from Disasters like the Earthquake in Japan

How to Protect Yourself from Disasters like the Earthquake in JapanDevelop A Good Emergency Plan to Also Protect Yourself Financially The...

Can Your House Lend a Hand? Here’s What You Need to Consider

Can Your House Lend a Hand? Here's What You Need to ConsiderQ: I’m a stay at home mom and my husband’s been on short term disability for...

Spring Break Staycation

Spring Break Staycation Q: Spring Break is looming once again. We try and get away somewhere warm most years but this year, we just can’t...

Ads for debt settlement companies sound great. Why not go for it?

Ads for Debt Settlement Companies Sound Great. Why Not Go for It? Q: I keep hearing and seeing ads from companies that claim to be able to...

Why Save when Borrowing is Cheap?

Why Save When Borrowing is Cheap? Q: A friend of mine was giving me a hard time the other day. I wanted to delay my travel plans until I had...

What Would Your Community do with an Extra Million Dollars?

What Would Your Community Do with an Extra Million Dollars? A major TV network is looking at producing a reality TV show that aims to help...

What to Watch Out for with New Car Ads

What to Watch Out for with New Car Ads Q: I'm thinking about replacing my car. Looking at the new car ads and financing options available, it...

How to Protect Yourself from a New Form of Identity Theft

How to Protect Yourself from a New Form of Identity TheftNew Danger PayPass is MasterCard's RFID smart card. The circled icon in the corner...

What Do the New Mortgage Rules Mean—in Plain English?

What Do the New Mortgage Rules Mean in Plain English? At the beginning of this week, the federal finance minister announced some changes to...

The 4 Biggest Secrets of Debt Reduction in Canada

The 4 Biggest Secrets of Debt Reduction in CanadaMany people wonder what the best strategies are for reducing their debt. While it’s usually...

Are You Tired of Being the Family Bank?

Are You Tired of Lending Money to Relatives and Being the Family Bank?Below is a question and answer piece about lending money to relatives...

How to Tackle Credit Card Debt & Save Thousands of Dollars

How to Tackle Credit Card Debt & Save Thousands of Dollars Q: Each year, I resolve to tackle my credit card debt and I never seem to get...

How to Save Time and Money on Christmas Gifts

How to Save Time and Money on Christmas Gifts Q: My husband and I are immigrants and over the years, our extended family has grown a lot....

How Credit Counselling Can Help You Resolve Your Financial Challenges

How Credit Counselling Can Help You Resolve Your Financial ChallengesMany people who are struggling to pay their bills and make their payments...

How to resolve fighting over money: look below the surface

How To Resolve Fighting Over Money: Look Below The SurfaceQ: My partner and I fight about money all the time. She's a spender and I'm a saver....

How to Buy Christmas Gifts for 50% Less

How to Buy Christmas Gifts for 50% Less Are you looking to stretch your dollars this Christmas? This year it's possible to buy a lot of really...

How to manage your money the S.M.A.R.T. way

How to Manage Your Money the S.M.A.R.T. Way Q: I never have any money left over after paying my bills to even think about financial goals. I'm...

How to Find a Reliable Company to Help with Debt Problems

How to Find a Reliable Company to Help with Debt ProblemsQ: I'm having trouble keeping up with my debt payments and I think I need to talk...

Should you buy your next big screen TV in Canada?

Should You Buy Your Next Big Screen TV In Canada? Q: My best friend and I have a bet going this year on who can get the best deal for a...

3 Ways to make “fitting in” at work less expensive

3 Ways To Make "Fitting In" At Work Less Expensive Q: I've finally found a new job and I really like my work. However, it seems that it's...

What’s Haunting You?

What's Haunting You? What’s your worst fear? Relaxing in your favorite chair and feeling a spider crawl up your leg? Being woken from your...

7 Steps to a Great Credit Score in Canada

7 Steps to a Great Credit Score in CanadaHave you ever wondered if only rich people have fabulous credit scores? Wonder no longer. The truth...

Debt Settlement Companies: The good, the bad and the ugly

Debt Settlement Companies: The good, the bad and the uglyQ: I heard an ad for a company. They said that they can settle my debt for much less...

What Debt Settlement Companies Don’t Tell You

What Debt Settlement Companies Don't Tell YouLast week we heard an American debt settlement company advertise on a Canadian radio station. In...

What do Bank of Canada announcements mean for my wallet?

What Do Bank Of Canada Announcements Mean For My Wallet?Do you ever wonder what those Bank of Canada announcements that come out almost every...

What you need to know before you pop the question

What You Need To Know Before You Pop The QuestionQ. I'm going to propose to my girlfriend during the holidays, but from what I've seen and...

People tell us what credit counselling means to them

People Tell Us What Credit Counselling Means To ThemLike so many of you, all of us at the Credit Counselling Society work hard every day. The...

For a Couple, How Important is It That Each Person Has Their Own Credit Rating?

For A Couple, How Important Is It That Each Person Has Their Own Credit Rating?Q: My husband and I have been through some rocky times over the...

Don’t Let Your Worst Financial Fears Become Your Reality

Don't Let Your Worst Financial Fears Become Your RealityQ: I am a mature woman and I've just got divorced for the second time. My children are...

Pictures of Our Offices

Pictures of Our Credit Counselling OfficesSince we first opened our doors in 1996, we’ve been constantly amazed at the growing number of...

How Blended Families can Prevent Fighting about Money

How Blended Families Can Prevent Fighting About Money Q: My spouse and I are both in our second marriages and we share custody of our kids...

Could You Survive Missing a Paycheque? A new survey says 60% of Canadians couldn’t

Could You Survive Missing a Paycheque?A new survey says 60% of Canadians couldn'tLast week the Canadian Payroll Association released a survey...

How to Protect Yourself from Rising Interest Rates

How to Protect Yourself from Rising Interest RatesLast week, the banks raised their mortgage interest rates for the third time in three...

The Importance of a Good Credit Score

The Importance of a Good Credit ScoreQ: I'm having a hard time getting my son to understand the importance of a good credit rating. He lives...

Keeping the Magic Alive: Date Nights & Your Finances

Keeping the Magic Alive: Date Nights & Your FinancesQ: My wife tells me that relationship experts say that going on regular "dates" with your...

Student Budgeting 101: Move a set amount to bank account biweekly and live with it

Student Budgeting 101: Move a set amount to bank account biweekly and live with it Q: Our son is going to university and for the first time...

Learning the Basics With Back to School

Learning the Basics with Back to SchoolQ: Our son is starting at a new school for grade 7 this September, and they’ve emailed us a very long...

Avoid Technology’s Traps: How to put the need for the latest gadgets into perspective

Avoid Technology's Traps:How to put the need for the latest gadgets into perspective Q: It's really expensive keeping up with technology these...

How to Help Your Teenager Learn to Budget & Save

How to Help Your Teenager Learn to Budget & SaveQ: My teenager has been working for several months but seems to spend his money as fast as he...

How to Maximize your Back-to-School Budget

How to Maximize your Back-to-School BudgetKids will soon be headed back to school, and for many families this represents one of the year’s...

How to Give When Money is Tight

How to Give When Money's Tight Q: We value the work of charities and believe very strongly in giving to good causes. Our income is down this...

How to Cope with Living in Canada while Sending Money to Family Oversees

How to Cope with Living in Canada while Sending Money to Family OverseesQ: My husband and I immigrated to Canada almost 20 years ago to give...

When is the Best Time to Buy a House?

When is the Best Time to Buy a House? Q: Mortgage rates are still low and house prices keep going up. Is now the time to buy? And is it better...

Gambling: How to tell if you’ve gone too far

Gambling: How to tell if you've gone too farQ: It's fun to go to the casino with friends on occasion, but one friend seems obsessed about...

8 More Money Mistakes that Keep People Broke

8 More Money Mistakes that Keep People BrokeLast week we shared eight common mistakes that keep people broke. A lot of you asked for more...

Do You Ever Get Even with Revenge Spending?

Do You Ever Get Even with Revenge Spending?Q: After finding out that my partner spent over $1000 on toys for his car, I had a spa day and got...

Financial Help or Handout – When has it gone too far?

Financial Help or HandoutWhen has it gone too far? Q: My parents keep borrowing against the equity in their home to bail my sister and her...

Credit Counselling Society Wins National Award

Credit Counselling Society Wins National Award The Credit Counselling Society was presented with the Credit Counselling Canada Agency Award at...

A “SMART” Way to Manage Income

A "SMART" Way to Manage Income Q: I never have any money left over after paying my bills to even think about financial goals. I'm frustrated...

Average Canadian Bride Spends $20,000 on Her Wedding: 5 Ways to Make Your Wedding More Affordable

Average Canadian Bride Spends $20,000 on Her Wedding: 5 Ways to Make Your Wedding More AffordableIs there an expectation in your family that...

Do Summer Vacations Leave You Broke? Here’s an Idea

Do Summer Vacations Leave You Broke? Here's an IdeaQ: My family usually takes a summer vacation, away from home. And while we have a lot of...

Should You Rent or Buy a Home (House or Condo)?

Should You Rent or Buy a Home (House or Condo)? Is it better to rent or buy a home? Many people ask this question, but often only hear one...

Are Canadians Reckless Spenders? A New Study Says We Are

Are Canadians Reckless Spenders? A New Study Says We Are A new study from the Certified General Accountants Association of Canada shows that...

Entitled to Live Beyond Your Means

Entitled to Live Beyond Your MeansWhen we help people with their debts we always ask them what they think caused their debt problem. People...

7 Common Bankruptcy Myths in Canada

7 Common Bankruptcy Myths in Canada Bankruptcy; for many people who are experiencing financial difficulty, it’s one of the first things that...

12 Ways to Get Out of Debt

12 of the Most Effective Ways to Get Out of Debt Many people would love to pay down their debt or get rid of it altogether, but they aren’t...

3 Ways to Protect Yourself from Events like the Iceland Volcano

3 Ways to Protect Yourself from Events like the Iceland VolcanoFor the last 5 days, a cloud of volcanic ash from a volcano in Iceland has...

Does your credit score fall every time someone checks it?

Does Your Credit Score Fall Every Time Someone Checks It? Has anyone ever told you that every time someone checks your credit, it lowers your...

Rising Interest Rates Could Double Your Mortgage Payments

Rising Interest Rates Could Double Your Mortgage PaymentsUp until now, for almost 30 years, interest rates have been declining in Canada. This...

What to do if you dread filing taxes

What To Do If You Dread Filing TaxesQ: I always dread filing my taxes. I usually owe a few hundred dollars and struggle to find the money to...

Budgeting in Easy 3 Steps

Budgeting in Easy 3 StepsMany people think that budgeting is really complicated. It's not. All you have to do is create a spending plan and...

The 7 Smartest Things You Can Do for Your Finances

The 7 Smartest Things You Can Do for Your Finances Have you ever wondered what the best things are that you can do for your financial future?...

7 Ways to Protect Yourself from Rising Interest Rates

7 Ways to Protect Yourself from Rising Interest RatesLast week, the banks raised their fixed mortgage rates and there is a growing consensus...

Rising Mortgage Rates will be Difficult for Many Canadians